Tax Information

The following information is provided for general assistance related to the IRS Form 1098-T but should not be construed as tax advice. Please consult IRS Publication 970 or contact a tax advisor if further assistance is needed.

IRS form 1098-T is issued to assist in determining whether education credit can be claimed. The 1098-T is an informational report that shows payments received for qualified tuition and fees during the calendar year as well as scholarships or grant aid applied to student accounts during the calendar year. Receipt of a 1098-T does not automatically establish eligibility for educational tax deductions or credits, nor does it provide all information that might be needed to calculate any taxable portion of scholarships/grants received.

Obtaining Your 1098T

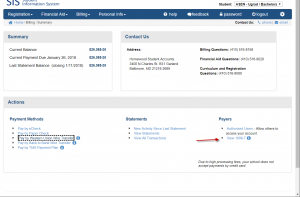

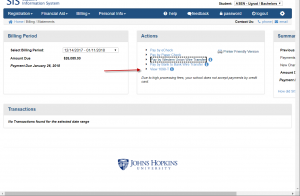

Please login to SIS Self-Service to access your 1098T. Go directly to Billing>Summary or Billing Statement Tab.

Click the “View 1098T’ link

Frequently Asked Questions

Please note: JHU Krieger School of Arts and Sciences and Whiting School of Engineering or the JHU Tax Office cannot answer tax questions or advise you concerning tax-related issues.

Who is required to be issued an IRS Form 1098‐T?

JHU Krieger School of Arts and Sciences and Whiting School of Engineering must file a 1098‐T form for each enrolled student for whom a reportable transaction was made during the calendar year January 1 to December 31. A reportable transaction is defined as qualified tuition and related expenses required for a student to be enrolled at or attend an eligible educational institution and any scholarships or grants administered and processed for payment of the student’s cost of attendance.

Who is NOT required to be issued the IRS Form 1098‐T?

- Students enrolled in courses for which no academic credit is offered, even if the student is otherwise enrolled in a degree program.

- Nonresident alien students.

- Students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarships and/or other formal billing arrangement between an institution and the student’s employer, government entity, such as the Department of Veterans Affairs or the Department of Defense.

Does JHU Krieger School of Arts and Sciences and Whiting School of Engineering report my payments?

Due to an IRS requirement change, beginning with calendar year 2018, educational institutions must report based on payments received for qualified education expenses within the tax year. This is reported in Box 1 of the Form 1098-T. However, the amount reported on your Form 1098-T, box 1, might differ from the amount you actually paid and are deemed to have paid. The IRS reminds the taxpayer, “When figuring an education credit, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses.” To get a summary of your charges and payments by term, you can view and print your account activity in SIS.

How does a student receive IRS Form 1098‐T from JHU Krieger School of Arts and Sciences and Whiting School of Engineering?

If you did not choose electronic delivery, the 1098‐T form will be mailed to your last known permanent address of record provided to JHU Krieger School of Arts and Sciences and Whiting School of Engineering as of December 31.

Any current student wanting to update their SSN with the Registrar’s office should complete our web form, providing a scan of the SSN card along with a photo ID from their JHU email address. The documents will be reviewed and updated to SIS.

Am I eligible to receive a Form 1098-T?

Generally, student who are/were enrolled at JHU and have been billed for tuition should receive a Form 1098-T. However, some exceptions are:

- Students billed only for courses for which no academic credit is offered. (non-credit courses)

- Nonresident alien student

- Qualified tuition and related expenses are entirely waived or paid entirely with scholarships or grants, i.e. the amount of scholarships/grants (and alike) posted to student accounts exceed the amount of qualified tuition and related expenses posted to student account.

How do I view my Form 1098-T online?

Sign in to SIS Self-Service to access the 1098T. Select Summary under the Bill at the top of the page. Then click View 1098-T in the Actions box.

Who do I contact with any questions regarding my Form 1098-T?

Contact the Student Accounts office of the JHU school you were/are attending.

How many years are available actively online?

The current tax year and the prior two years are available actively online.

I have graduated and no longer have access to SIS. How can I get a copy of my 1098-T?

After graduating, an alumni account will need to be created. The 1098-T can then be viewed by logging into SIS with the alumni account login ID and password.

Are CARES Act funds reported on Form 1098-T?

No, the emergency financial aid grants are qualified disaster relief payments are not included in the amount reported in Box 5. See the IRS website for additional information.