Financial Procedures

All Registered Student Organizations must follow all financial rules, regulations, and policies outlined by Johns Hopkins University and the Leadership Engagement & Experiential Development office. Proper fiscal management is taken very seriously, and failure to uphold institutional policies could result in disciplinary action.

Registered Student Organization Finance Manual

Registered Student Organization Finance Manual

For inquires related to RSO financial matters, please contact the LEED office at (410) 516-4873 or click the button below:

General Guidelines

- The student organization fiscal year runs from August 1 through the last day of final exams in the spring semester. All student organization financial transactions must be completed by the last day of final exams. This includes purchases, vendor payments, reimbursements, etc.

- While Leadership Engagement and Experiential Development (LEED) manages an account for your student organization, it does not mean funds are available. Financial transactions will not be processed if funds are not available. If an account is in deficit, the Treasurer must work with LEED to determine steps to correct the situation quickly.

- Accounts for active groups with no financial activity for two consecutive semesters will be reviewed and may be closed with loss of any funds in the account.

- Registered Student organization accounts start with ‘800’, is an internal order (IO) under fund center 1311000005.

- Student groups may not maintain an external bank account unless affiliated with a national organization that specifically requires them to do so.

- Do not state that your student group will provide cash prizes or give out cash prizes at an event.

- Cash Payment to vendors or students is prohibited.

- The purchase of alcohol and/or alcohol-related items (shot glasses, bottle openers, beer mugs etc.) with student organization funding is prohibited. Students will not be reimbursed for any alcohol-related purchase.

- Any items purchased using student organization funds are the property of JHU.

- All funds (ticket sales, fees, fundraising proceeds, etc.) received by JHU-recognized organizations are the property of JHU.

- Student Organizations recognized by SGA are required to follow Student Activities Commission guidelines. Email Student Activities Commission (SAC) for questions related to SAC funding.

Financial Officers

- The first and primary financial officer is the group’s Treasurer/Financial Officer. The secondary Financial Officer is the President of the student organization.

- Only financial officers may initiate financial requests for their organizations. This includes purchase requests, account balances, and reimbursements. Financial Officers are managed by the individual RSOs.

- To initiate a financial request in Hopkins Groups, go to the RSO’s Budgeting page.

- The Treasurer/Financial Officer is responsible for keeping track of the group’s budget and must keep a running ledger of the group’s financial activity. We have created a Student Organization Budget Ledger Template for groups to use as a resource.

- Financial summary and YTD Detailed Reports are uploaded monthly within each organization’s Hopkins Groups account. Student organizations are responsible for reviewing their financial reports for accuracy and reporting any discrepancies to LEED financial staff as soon as they are discovered. Positive amounts on the Detailed Report reflect outgoing money; negative, as denoted by (), amounts are incoming money. A negative ending balance on the Summary Report means there are available funds in the account.

- A graduate student cannot be a financial officer of an undergraduate group.

Paying a Vendor with a Federal Tax ID Number

This vendor type is incorporated and has a Federal Tax ID Number (i.e., XX-XXXXXXX). To pay a vendor with a Federal Tax ID Number, you must submit a “Payment Request on Hopkins Groups at least 14 days in advance of your event. You will be required to submit the following documents along with your request, so please have them prepared in advance:

- An original itemized invoice (excluding Maryland state sales tax) or contract. The payment document must say “Invoice” to be valid. Payment documents with “quote,” “statement,” or “estimate” are invalid and will not be processed. Under no circumstances should a student sign any contracts! All contracts must be reviewed by LEED staff before they are submitted to Purchasing. Ensure your payment document (invoice, contract) does not include Maryland sales tax. Provide the vendor with the JHU Maryland Sales Tax Exemption Card before them creating the invoice or contract.

- A PDF Document: W-9 is required for all vendors unless they are already in the JHU Accounting System. This form is required for vendors to complete their registration in PaymentWorks.

- To ensure a specific vendor is already a JHU vendor, please contact the LEED office at [email protected].

New vendors to JHU will need to be submitted through PaymentWorks. To ensure timely payment for new vendors, please submit the vendor’s name, email, amount of anticipated spend, and a brief description of services address to the LEED office at [email protected].

Paying an Independent Contractor

An Independent Contractor (IC) is an individual or non-corporate business entity that provides personal services while retaining control over the means and methods of accomplishing the work. The IC uses a personal SSN (i.e., XXX-XX-XXXX) as their Federal Tax ID. Examples of ICs are a DJ, a guest director, a speaker, a contest judge, and a dance instructor. To pay an Independent Contractor, you must complete the Hopkins Groups at least 14 days before your event. You will be required to submit the following documents along with your request, so please have them prepared in advance:

- An original itemized invoice (excluding Maryland state sales tax) or contract. The payment document must say “Invoice” to be valid. Payment documents with “quote,” “statement,” or “estimate” are invalid and will not be processed. Under no circumstances should a student sign any contracts! All contracts must be reviewed by LEED staff before they are submitted to Purchasing. Make sure your payment document does not include Maryland sales tax. Provide the vendor with the JHU Maryland Sales Tax Exemption Card before them creating the invoice or contract.

- A PDF Document: W-9 is required for all vendors unless they are already in the JHU Accounting System. This form is required for vendors to complete their registration in PaymentWorks.

- A completed Independent Contractor Short Form with the vendor’s signature, title, and date at the bottom of the second page.

- To ensure a specific vendor is already a JHU vendor, please contact the LEED office at [email protected].

New vendors to JHU will need to be submitted through PaymentWorks. To ensure timely payment for new vendors, please submit the vendor’s name and email address to the LEED office at [email protected].

Due to Federal tax laws and penalties, never pay an IC directly via individual member check or cash. JHU will not reimburse a group member if this happens.

Purchasing Goods & Food

LEED believes students should not be financially burdened to participate fully in their organization. For this reason, we expect student groups to plan to purchase supplies and goods. You must complete Request Payment on Hopkins Groups to make an order. Submission deadlines vary depending on what type of order you are placing. Please review the instructions below for our most common online purchases and their requirements.

Orders will only be processed for events registered in Hopkins Groups.

Imprinted Goods

If you would like to order imprinted goods (postcards, cups, mugs, giveaways, etc.), your Payment Request Form in Hopkins Groups must be submitted at least 6-8 weeks in advance. Items branded with the JHU logo/name must meet JHU brand guidelines. You will be required to submit a draft of your design as part of your purchase request, so please have it prepared in advance.

Preferred vendors are Custom Ink, Blue Sky Marketing, and Forbes Marketing.

Goods & Supplies

For online orders (Amazon, Office Depot, etc.), your Payment Request on Hopkins Groups must be submitted at least 14 business days before your event. Amazon is JHU’s preferred vendor, and as such, JHU Purchasing has negotiated some items to be offered to us at a discounted rate.

- Amazon Orders: To make an Amazon order, simply visit amazon.com, create a wish list, and make it public. When you submit your Payment Request on Hopkins Groups, you will be prompted to enter the link to your wish list. Once your form has been approved, a staff member will place your order. We ask students to use Amazon as the primary source for online purchases of supplies and goods.

- Other: If you cannot purchase your required items through Amazon, please submit the Payment Request on Hopkins Groups. Once your form has been approved, a staff member will place your order.

Catering & Groceries

To provide better service and streamline the catering order process, student organizations can pick from the following options when ordering food for their event:

- Grocery Delivery: Student groups are encouraged to purchase all groceries for their events using Amazon Prime Pantry. Deliveries are convenient and quick! To order groceries, please visit Amazon Prime Pantry to compile your order and submit a Payment Request on Hopkins Groups to place your order.

Reimbursing a Group Member

To request pre-approval for a purchase, submit a Payment Request on Hopkins Groups at least 14 business days before your event or expense. LEED believes that students should not have to incur a financial burden to participate fully in their organization. For this reason, we encourage student groups to plan to secure advance payment (purchase order, check request, etc.) for purchases. Reimbursements are reserved for instances when advance payment is not possible. They will be approved on a limited basis. See the Travel Reimbursement section below for specific travel reimbursement procedures.

After your expense has been approved, you may make your purchase. To get reimbursed for your expense, you must upload the receipt(s) to your Payment Request on Hopkins Groups within 30 days of the receipt date or by the last day of final exams for that semester, whichever is sooner. As the Payment Request form cannot be altered once submitted, the receipts must be uploaded to the chat associated with the request. Please include the name and address where they wish the reimbursement to be sent.

- Itemized receipts must show a breakdown of items purchased (including food), as well as the method of payment (i.e., credit card type, cash, etc.). A credit card payment receipt alone is not enough.

- JHU does not reimburse sales tax. To make a tax-exempt purchase, you must give the JHU Maryland state sales tax exemption certificate to the vendor or online business before purchasing. It is illegal to use a Maryland tax exemption certificate for personal purchases.

- For audit purposes, a financial officer cannot request a payment to themselves. The President or Second Financial Officer must submit a Payment Request on Hopkins Groups.

- Students are not authorized to pay a vendor or individual out of pocket and will not be reimbursed for these expenses.

See the Travel Reimbursement section below for specific travel reimbursement procedures.

Travel and Hotel Accommodation Request Form

Student groups or individuals participating in travel sponsored by a JHU organization or on behalf of a student organization are required to submit a Travel and Hotel Accommodation Request Form at least 30 days in advance of travel but preferably as soon as the trip has been confirmed. Transportation (airplane, train, bus, etc.) and hotels must be booked in advance by the Budget Specialist in Leadership Engagement and Experiential Development (LEED) through World Travel Inc. All student organization travel and hotels will be booked at a standard accommodation level (Please refer to the GSA guidelines web page linked here). Reservations must not exceed the occupancy limit defined by the hotel. Students will not be reimbursed for travel-related expenses not pre-approved by the organization advisor or Leadership Engagement & Experiential Development.

- Due to liability issues, JHU Risk Management policy does not let students travel over 300 miles round trip in any personal car or JHU Hop Van. Public transport (i.e., airplane, train, or bus) must be used. There are no exceptions to this policy.

- Names, birth dates, sex, and email addresses must be given for each traveler. For international travel, passport numbers and expiration dates are also required.

- If a student organization needs to cancel or change their travel plans, it is their responsibility to make adjustments by the deadlines indicated by the vendor. If a trip is not canceled by the designated deadline or individual(s) fail to show up for a scheduled trip, the organization account will be charged the full amount billed to JHU.

Student Organization Travel Abroad

Below is the process by which student organizations must complete before participating in international travel.

- Have one student leader complete the forms on the Student Organizations Abroad page:

- Two Forms

- International Activity registration Forms

- Student Organization Sponsored International Activity Proposal

- What you need to complete the form:

- Travel information (where, how)

- Contact in country (who to contact on site not the student – i.e., event organization, etc.)

- Two Forms

- Submit to Dr. Lori Citti, Director of Study Abroad at [email protected].

- Receive approval from to travel from Dr. Lori Citti.

- Purchase travel with your university budget person.

- How to navigate to the form.

- Go to the Study Abroad website.

- Hover over “Find a Program”

- Hover over “Non-Credit Experiences Abroad”

- Click “Activities Abroad”

- Click “Student Organizations Abroad”

- Review Information on the website

- Select a trip leader

- Select both “Quick Links” on the right hand side

Transferring Funds

- Transferring of funds occurs when a student organization wants to move funds from their account to another group account or another Johns Hopkins entity. This can also reverse when a group receives funds from departments or other student groups.

- For fund transfers out of a student group account, submit a Payment Request on Hopkins Groups and select “Transfer” from the dropdown menu.

Receiving & Depositing Money

All funds collected on behalf of a sponsored student group or organization are the property of Johns Hopkins University and cannot be used for personal purposes. To make a deposit, bring checks and cash along with a completed Word Document: Deposit Transmittal Form to the Leadership Engagement and Experiential Development (LEED) office, Monday through Friday between 9:00 a.m. and 4:30 p.m. Weekend and after hours deposits can be made at Levering Hall. For after hours deposits, please see the monitors in Levering Hall. Do not leave deposits in the Leadership Engagement & Experiential Development mailbox or under the office door.

- Checks: Checks must be deposited within 48 hours of receipt. To deposit into your organization’s revenue account, you must bring a completed Word Document: Deposit Transmittal Form, check, and the envelope it arrived in. All charitable donations will be processed through the Office of Development and Alumni Relations. Please note a 4% processing fee is assessed. If a check is for a charitable contribution and the donor wants a tax deductible letter from JHU, be sure to denote that on the deposit form. Do not mix charitable and non-charitable deposits on the same deposit form. If there is a national organization, JHU cannot accept the donation. Make and retain copies of all checks before you turn them into LEED. This is important if a refund is required later.

- Fundraisers/Ticket Sales: All online event purchases are required to be sold through Hopkins Groups. You may not sell tickets through EventBrite or other ticket sale platforms or collect money directly for ticket sales (see JHUTickets overview below).

- Cash: Cash boxes with locks are available for events collecting under $250 in revenue. Events with revenue over $250 are required to accept J-Cash, or use Hopkins Groups as a payment source instead of accepting cash. Contact [email protected] coordinate cash box arrangements.

- PayPal, VenMo, CashApp etc.: At this time, the university does not have the capability to accept electronic donations from PayPal, VenMo, Kickstarter, or similar platforms. Groups are not permitted to use these platforms to raise funds or conduct other transactions for their groups.

Fundraising Guidelines

Registered Student Organizations seeking to raise money on behalf of their organization or behalf of an outside organization must comply with the Registered Student Organization Financial Manual. The term fundraising covers any occasion where a student organization collects money. Some examples include bake sales, ticket sales, raffles, grant applications, and the solicitation of donations.

- JHU Grant Programs: Johns Hopkins University has several grant programs available to student organizations. Please visit the Grants page for more information about the various grants, their requirements, and deadlines to apply.

- External Grant Programs: Student Organizations may not independently solicit grant funding from outside organizations. Grant management is monitored very closely by the University because proposing/receiving/managing/closing out a grant is often a multi-year process that involves entering a contractual agreement. Students are not authorized to sign contracts! If you are interested in applying for an external grant, you must contact LEED to discuss your proposal.

- Donations from Local Businesses and External Organizations: Groups often reach out to local businesses and outside organizations to sponsor their organization. All funds collected are considered charitable donations and will be processed through the Office of Development and Alumni Relations. (See section on Receiving & Depositing Money for information on depositing your monetary donation.) Non-monetary donations of goods do not require documentation through the Office of Development & Alumni Relations unless the donor wants a tax-deductible letter from JHU. Either way, make sure to send a thank you card!

- Fundraising for Other Organizations: If you would like to host a fundraiser for an outside organization, please work with your advisor, Category Coordinator, or LEED staff member to make arrangements.

- Bake Sales/Tabling Fundraisers: If you are hosting a bake sale or other tabling fundraiser, you must follow the Cash Handling Procedures, which outline the procedures for collecting and depositing cash.

- Collecting Donations through JHU Giving Page: Student Organizations can work with Development and Alumni Relations to create giving pages through JHU’s secure site: https://secure.jhu.edu/form/givenow. Students, alums, and community members can choose an option from the list, or if your group is not listed, they can select the Other designation and write in the name of your group.

- Note: Please do not solicit JHU alumni directly on behalf of your organization. If you would like to reach out to alums, please contact Alumni Relations, and they will help advise your organization.

- Alumni Relations created the following links to allow student organizations to crowdfund through the University. Please select the appropriate category and select the appropriate RSO. If the RSO is not listed, have the donor select “other” and enter the the RSO’s group name.

- Student Life, Initiatives, Programs, Unions, & Governing: https://makeagift.jhu.edu/form/IPUGSGA Advocacy & Awareness: https://makeagift.jhu.edu/form/SGAAASGA Culture & Identity: https://makeagift.jhu.edu/form/sgaciSGA Religious: https://makeagift.jhu.edu/form/SGARSGA Publication & Media: https://makeagift.jhu.edu/form/SGAPMAcademic, Research, Honors, & Professional Societies: https://makeagift.jhu.edu/form/ARHPSGraduate Student Organizations: https://makeagift.jhu.edu/form/GSOHomewood Arts Programs: https://makeagift.jhu.edu/form/HAP

- Alumni Relations created the following links to allow student organizations to crowdfund through the University. Please select the appropriate category and select the appropriate RSO. If the RSO is not listed, have the donor select “other” and enter the the RSO’s group name.

- Reminder: Groups cannot accept electronic donations from PayPal, Venmo, Kickstarter, or similar platforms to raise funds or conduct other transactions for their groups. Organizations can collect electronic donations using JCash.

Cash Handling Procedures

For events on non-business days and/or ending after 4:30 p.m.

- You may use a Cash Box at your event if your revenue is under $250, events over $250 must use Hopkins Groups or J-Cash.

- Thirty minutes before you stop collecting money at your event, call the Levering Student Monitor at 410-516-8197 to let them know you will need a security officer to escort you to the safe. Deposits must be made 30 minutes before the building closes.

- Levering Hall: Sunday through Thursday the monitors are available until 11:30 pm. Fridays and Saturdays the monitors are available until 1:30 am.

- The LaB: Available until 11:30 pm, Monday – Friday.

- With the security officer, walk to the Levering Hall Monitor to deposit the money into the drop-safe.

- With the monitor…

- Count the money and place the money into an envelope with your name, email, group name, and budget number (if known)

- Sign and Take a Receipt with you

- Deposit the money into the drop-safe

- On the next business day, the Financial Coordinator for the Office of Student Leadership and Involvement will pick up the money from the drop-safe and deposit the money into your account. It may take a few days to be processed into your account.

For events on business days ending before 4:30 p.m.

- You may use a Cash Box at your event if your revenue is under $250, events over $250 must use JHU Tickets or J-Cash.

- When your event is over, go to The LaB: Office of Leadership Engagement & Experiential Development

- Tell a LEED staff member your group name and budget number (if known)

- Count your money in front of them and give them your money

- Sign and take a receipt with you

- The Financial Coordinator for the Office of Leadership Engagement & Experiential Development will deposit the money into your account. It may take a few days to be processed into your account.

Sales Tax Information for Registered Student Organizations

Johns Hopkins University is a non-profit, educational corporation incorporated in the State of Maryland, and as such, the University is responsible for complying with appropriate federal & state corporate tax laws.

Generally, the University is exempt under IRS code section 501(c)(3) from federal & state income tax. However, certain activities may result in unrelated business income which is subject to federal & state income tax.

The University is required by law to collect state sales tax on sales of goods in states where the University is required to collect sales tax, including the State of Maryland at the rate of 6%. The University must collect the 6% Maryland sales tax on sales of any tangible personal property sold and delivered in the State of Maryland. Tangible personal property includes items such as clothing including T-shirts, mugs, concessions/food, and books just to name a few examples. See list below for examples. Tangible means capable of being touched or having a physical presence.

The Leadership Engagement and Experiential Development (LEED) office will collect and pay the applicable sales tax on a monthly basis from registered student organizations that host fundraisers or sell items as listed below.

LEED will review the income, assess the 6% sales tax, and will transfer the funds from your organization’s account on your behalf to the JHU Tax Office. Tax will be taken from the sales amount in group funds where the fundraising has been deposited. The JHU Tax Office then remits the sales tax collected monthly and pays the tax to the State of Maryland in compliance with the policy.

https://finance.jhu.edu/depts/tax/salesandusemenu.html#Collecting%20Sales%20and%20Use%20Tax

Process

Each time a registered student organization hosts a fundraiser or sells tickets, the full information below needs to be placed in Hopkins Groups for approval. All events that require the collection of sales tax are entered into Hopkins Groups, either as a fundraiser or through sales of tickets/merchandise at events. Even if items are donated at cost/free and are sold to consumers, those items are eligible for incurring sales tax.

- Groups need to be entering in all events that utilize sales of goods into Hopkins Groups for

- Select the fundraiser icon on the event if you are tabling, fundraiser nights at a restaurant where you get a percentage of sales, etc.

- If you are selling tickets, please select ticket sales including those where you sell merchandise at ticketed events.

- When asked if you are collecting sales tax as part of the purchase price, please select

-

- Determine the sales price of each item to include this 6% MD sales tax as it will be removed from your profits to pay the State of Maryland.

-

- List the full information including:

- costs of the items for sale (includes the 6% MD sales tax.

- itemized list of what will be included in the items for sale

- if thrift store event, what types of items will be available

- if a ticket to an event with additional items list those items: for example, a ticket including admission to the event, a t-shirt, and lunch

- who the fundraiser will benefit including the name of the non-profit if donating proceeds

- attach a flier to HG event submission if applicable

- At the conclusion of the event (within 48 hours during the week and 72 hours on the weekend), a deposit of cash made from sales or a review of the online sales will be made in Hopkins Groups. This is an important step for the University to be able to assess the full amount of sales to determine the applicable sales tax amount to pay to the State.

- LEED will review the income made during the event, assess the 6% sales tax on applicable items, and will transfer the funds from your organization’s group funds account (where fundraising funds are deposited) on your behalf to the JHU Tax The JHU Tax Office then remits the sales tax collected monthly and pays the tax to the State of Maryland in compliance with the state policy.

- LEED will email the student organization leadership in HG sharing the total amount of sales and sales tax remitted on your behalf each month to have for your records and will record the sales tax paid on your group funds ledger in Hopkins Groups.

Taxable Items

To help determine what items are taxable and which are not, we are sharing a list below to help. This is not an exhaustive list, so if there are questions on what is applicable or not, please email Executive Director of Student Engagement Laura R. Stott at [email protected] with your item for review.

Sale items that are taxable:

- Items for sale

- Food items for sale (even if food items donated)- donuts, cookies, boba tea, churros,

- Non-food items including flowers, crafts,

- Clothing items for sale – t-shirts, sweatshirts, stickers, cups, bottles, branded merchandise

- Donated items for thrift stores and are sold to consumers

- Ticket sales for performances that have another item attached including a t-shirt, meal, or another tangible item

- Raffle tickets for a game of chance to win goods or items

- Purchased items for sale to consumers

Non-taxable:

- Ticket sales for performances only for educational or charitable purposes

- Restaurant fundraisers -where you work with a restaurant to provide you a donation of a percentage of sales from your organization sponsoring a night

- Money-donation-only fundraisers for donations to a non-profit for a cause or other reason

Creating a Paid Event on Hopkins Groups

Creating a Paid Event on Hopkins Groups Instructions

- Student organizations must be registered on Hopkins Groups.

- All the logistics of the event must be confirmed before the tickets going on sale (i.e. the room is reserved, entertainment is confirmed, contracts are signed, etc.).

- Student organizations must have an on-campus account.

When filling out the form, please keep in mind the following ticket information:

- Online ticket price must remain the same during the entire time it is on sale.

- Sales must begin on a weekday.

- State your refund policy, if applicable.

There are three options for distributing tickets:

- Print Option: The purchaser can print their ticket upon purchasing the ticket. At the event, scanners must be rented to scan the ticket. To rent a scanner, it costs $.50/ticket. The company requires a ten-day warning and 200-ticket minimum.

- Reservation Option: The purchaser does not have the option to print the ticket. Their information will be collected, and at the door, the students can check in attendees with an iPhone or Android Hopkins Groups app.

- Print and Reservation Option: The purchaser will print out a ticket and a reservation list will also be provided.

There is a service fee attached to using this system:

Free Tickets = $0.25 per ticket service fee

$0.01-$9.99 = $0.50 per ticket service fee

$10.00-$19.99 = $1.00 per ticket service fee

$20.00 and above = $2.00 per ticket service fee

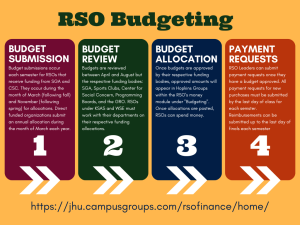

RSO Funding and Payment Requests

For details about RSO allocations and payment requests please visit:

PDF Document: RSO Funding Request InstructionsExcel Document: RSO Funding Request ExcelPDF Document: RSO Payment Request Instructions